Parallel Monto-Carlo options pricing¶

This notebook shows how to use ipyparallel to do Monte-Carlo options pricing in parallel. We will compute the price of a large number of options for different strike prices and volatilities.

Problem setup¶

[1]:

%matplotlib inline

import matplotlib.pyplot as plt

[2]:

import sys

import time

import numpy as np

Here are the basic parameters for our computation.

[3]:

price = 100.0 # Initial price

rate = 0.05 # Interest rate

days = 260 # Days to expiration

paths = 10000 # Number of MC paths

n_strikes = 6 # Number of strike values

min_strike = 90.0 # Min strike price

max_strike = 110.0 # Max strike price

n_sigmas = 5 # Number of volatility values

min_sigma = 0.1 # Min volatility

max_sigma = 0.4 # Max volatility

[4]:

strike_vals = np.linspace(min_strike, max_strike, n_strikes)

sigma_vals = np.linspace(min_sigma, max_sigma, n_sigmas)

[5]:

from __future__ import print_function # legacy Python support

print("Strike prices: ", strike_vals)

print("Volatilities: ", sigma_vals)

Strike prices: [ 90. 94. 98. 102. 106. 110.]

Volatilities: [ 0.1 0.175 0.25 0.325 0.4 ]

Monte-Carlo option pricing function¶

The following function computes the price of a single option. It returns the call and put prices for both European and Asian style options.

[6]:

def price_option(S=100.0, K=100.0, sigma=0.25, r=0.05, days=260, paths=10000):

"""

Price European and Asian options using a Monte Carlo method.

Parameters

----------

S : float

The initial price of the stock.

K : float

The strike price of the option.

sigma : float

The volatility of the stock.

r : float

The risk free interest rate.

days : int

The number of days until the option expires.

paths : int

The number of Monte Carlo paths used to price the option.

Returns

-------

A tuple of (E. call, E. put, A. call, A. put) option prices.

"""

import numpy as np

from math import exp,sqrt

h = 1.0/days

const1 = exp((r-0.5*sigma**2)*h)

const2 = sigma*sqrt(h)

stock_price = S*np.ones(paths, dtype='float64')

stock_price_sum = np.zeros(paths, dtype='float64')

for j in range(days):

growth_factor = const1*np.exp(const2*np.random.standard_normal(paths))

stock_price = stock_price*growth_factor

stock_price_sum = stock_price_sum + stock_price

stock_price_avg = stock_price_sum/days

zeros = np.zeros(paths, dtype='float64')

r_factor = exp(-r*h*days)

euro_put = r_factor*np.mean(np.maximum(zeros, K-stock_price))

asian_put = r_factor*np.mean(np.maximum(zeros, K-stock_price_avg))

euro_call = r_factor*np.mean(np.maximum(zeros, stock_price-K))

asian_call = r_factor*np.mean(np.maximum(zeros, stock_price_avg-K))

return (euro_call, euro_put, asian_call, asian_put)

We can time a single call of this function using the %timeit magic:

[7]:

%time result = price_option(S=100.0, K=100.0, sigma=0.25, r=0.05, days=260, paths=10000)

result

CPU times: user 174 ms, sys: 5.96 ms, total: 180 ms

Wall time: 211 ms

[7]:

(12.166236181100073,

7.6440122060909745,

6.8409606562778666,

4.4639448434953621)

Parallel computation across strike prices and volatilities¶

The Client is used to setup the calculation and works with all engines.

[8]:

import ipyparallel as ipp

rc = ipp.Client()

A LoadBalancedView is an interface to the engines that provides dynamic load balancing at the expense of not knowing which engine will execute the code.

[9]:

view = rc.load_balanced_view()

Submit tasks for each (strike, sigma) pair. Again, we use the %%timeit magic to time the entire computation.

[10]:

async_results = []

[11]:

%%time

for strike in strike_vals:

for sigma in sigma_vals:

# This line submits the tasks for parallel computation.

ar = view.apply_async(price_option, price, strike, sigma, rate, days, paths)

async_results.append(ar)

rc.wait(async_results) # Wait until all tasks are done.

CPU times: user 127 ms, sys: 15.7 ms, total: 143 ms

Wall time: 1.97 s

[12]:

len(async_results)

[12]:

30

Process and visualize results¶

Retrieve the results using the get method:

[13]:

results = [ar.get() for ar in async_results]

Assemble the result into a structured NumPy array.

[14]:

prices = np.empty(n_strikes*n_sigmas,

dtype=[('ecall',float),('eput',float),('acall',float),('aput',float)]

)

for i, price in enumerate(results):

prices[i] = tuple(price)

prices.shape = (n_strikes, n_sigmas)

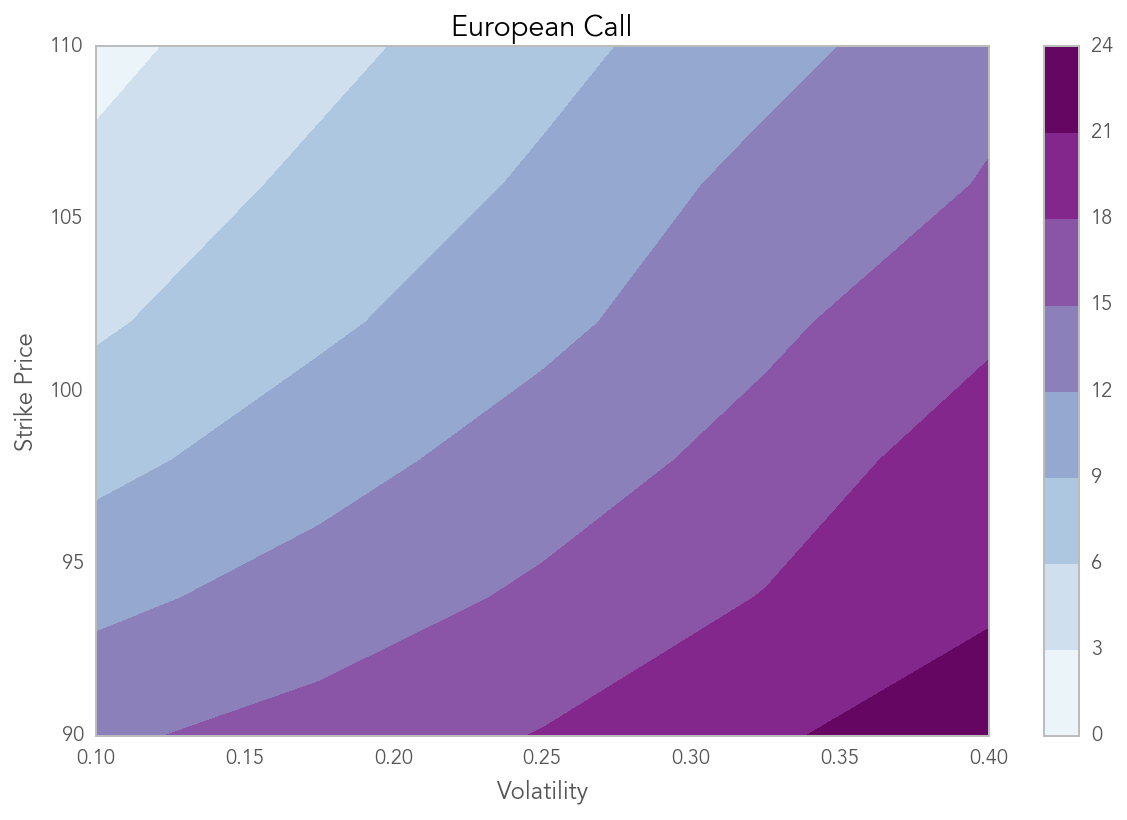

Plot the value of the European call in (volatility, strike) space.

[15]:

plt.figure()

plt.contourf(sigma_vals, strike_vals, prices['ecall'])

plt.axis('tight')

plt.colorbar()

plt.title('European Call')

plt.xlabel("Volatility")

plt.ylabel("Strike Price")

[15]:

<matplotlib.text.Text at 0x106036470>

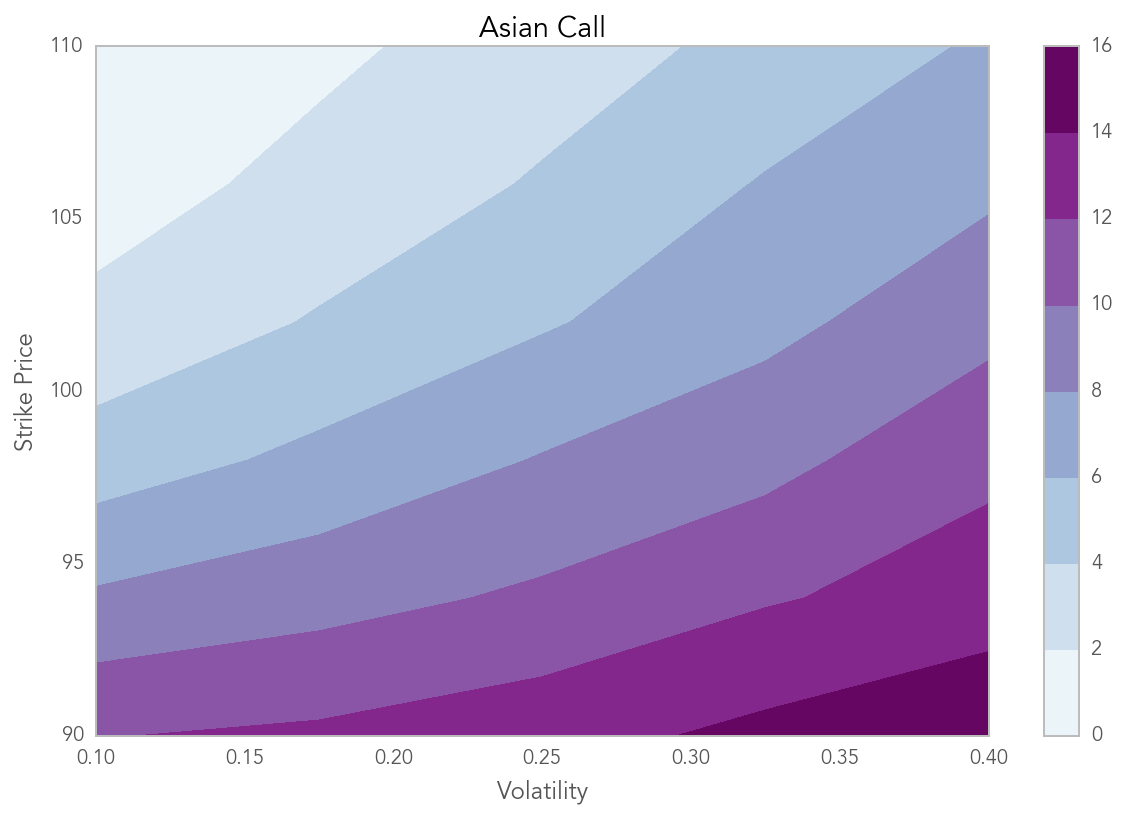

Plot the value of the Asian call in (volatility, strike) space.

[16]:

plt.figure()

plt.contourf(sigma_vals, strike_vals, prices['acall'])

plt.axis('tight')

plt.colorbar()

plt.title("Asian Call")

plt.xlabel("Volatility")

plt.ylabel("Strike Price")

[16]:

<matplotlib.text.Text at 0x1062d27f0>

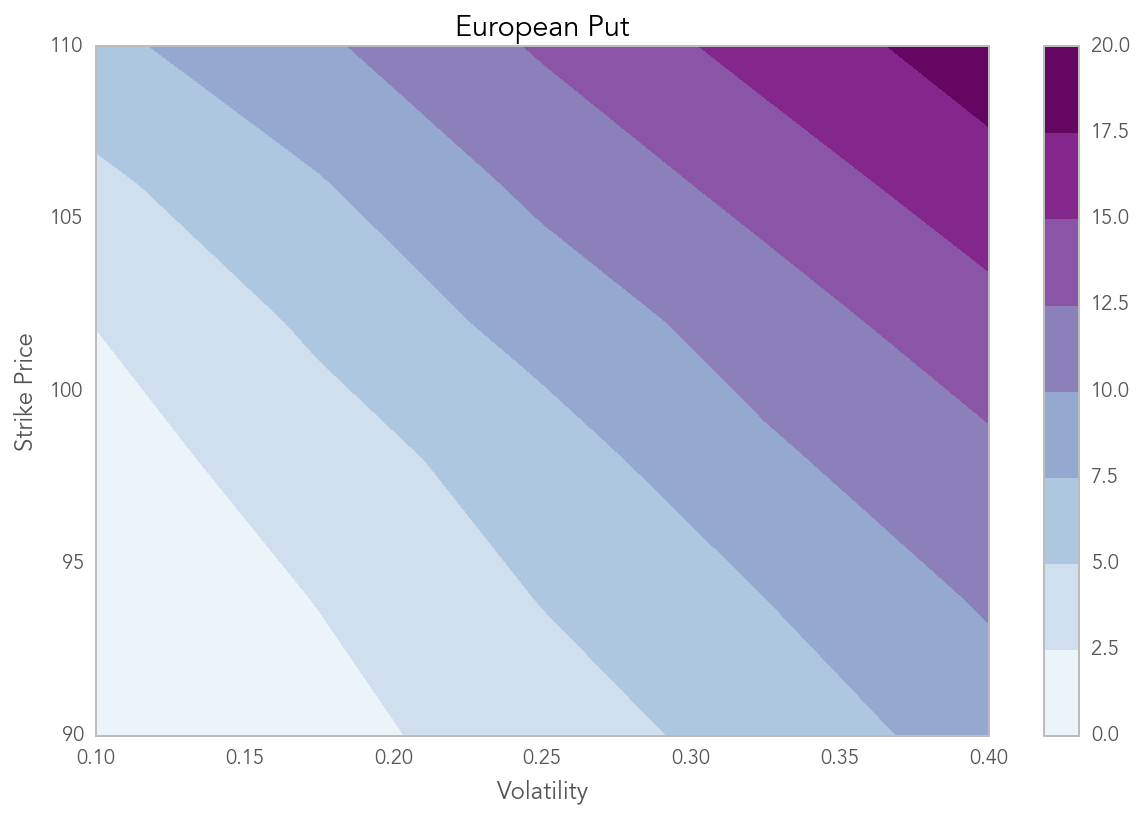

Plot the value of the European put in (volatility, strike) space.

[17]:

plt.figure()

plt.contourf(sigma_vals, strike_vals, prices['eput'])

plt.axis('tight')

plt.colorbar()

plt.title("European Put")

plt.xlabel("Volatility")

plt.ylabel("Strike Price")

[17]:

<matplotlib.text.Text at 0x106c0c748>

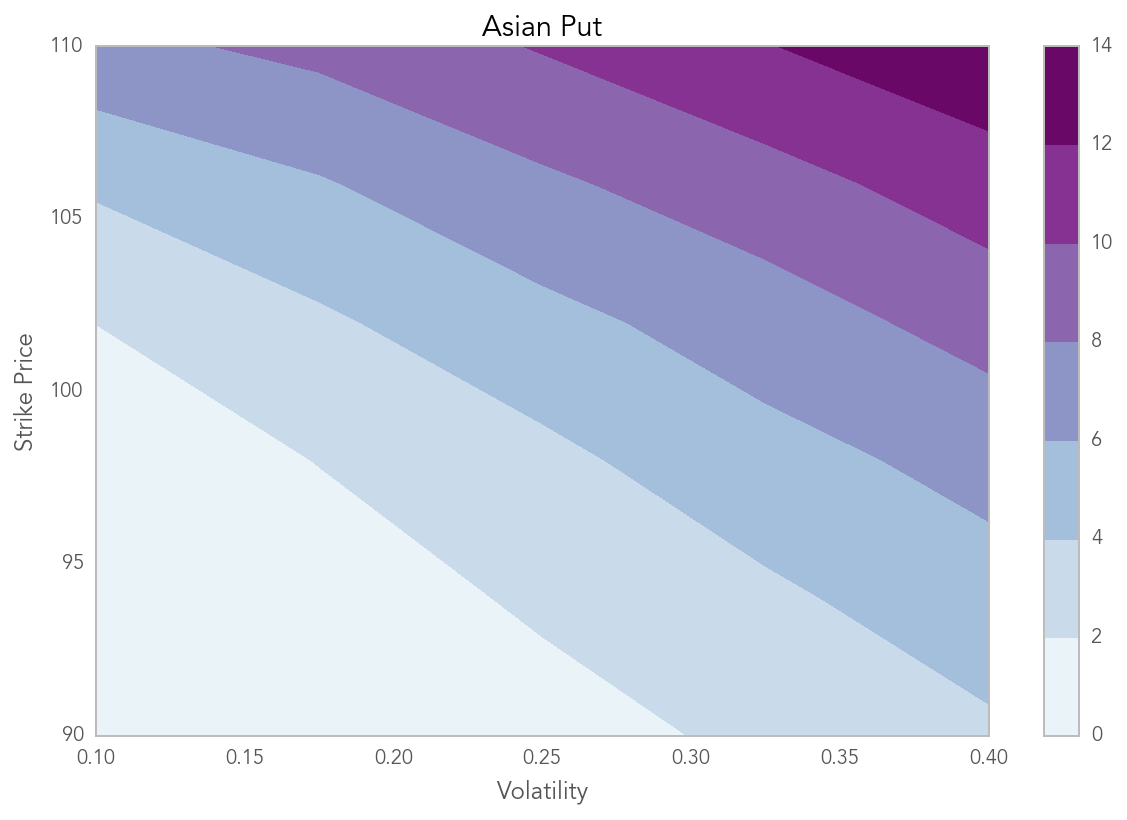

Plot the value of the Asian put in (volatility, strike) space.

[18]:

plt.figure()

plt.contourf(sigma_vals, strike_vals, prices['aput'])

plt.axis('tight')

plt.colorbar()

plt.title("Asian Put")

plt.xlabel("Volatility")

plt.ylabel("Strike Price")

[18]:

<matplotlib.text.Text at 0x1078690b8>